London School of Business & Finance is a part of the Global University Systems group of companies (the GUS Group). The information you provide on this form will be processed in accordance with London School of Business & Finance's Privacy Policy. London School of Business & Finance will use the details provided by you to get in touch with you about your enquiry.

What are mergers, acquisitions and private equity?

Mergers, acquisitions and private equity are essential components of business operations, as they assist companies to increase their value. Earning a Master in mergers, acquisitions and private equity can help students become business professionals who are capable of handling corporate financial issues.

Learning Outcomes

Graduates of the Master in Finance and Investments (Mergers, Acquisitions and Private Equity) will possess career-ready skills in:

- Relevant financial and business analysis

- Creating profit while minimising risk

- Advanced financial decision making

- Domestic and international financial statements

- Corporate governance and ethical issues

-

You will study your programme with London School of Business & Finance. Your programme modules and learning content are delivered via the Canvas study platform, and feature the following resources:

- Professionally produced video lectures created by leading business practitioners

- A designated tutor who will provide support and feedback throughout your programme

- Case studies and discussion questions to enhance your understanding of theory in context

- Downloadable e-books and free library resources to aid your assignment writing and research

- Access to online forums where you can share and discuss new concepts with fellow students and professionals from around the world

- UK undergraduate degree or equivalent - any subject area

- English levels 5.5 IELTS (5.5 in all bands) or equivalent*

- Relevant work experience is an asset, but no work experience is required

The Master in Finance and Investments degree syllabus considers today's challenging business environment and the financial expertise you need to excel within it. The 3 core and 3 elective modules will equip you with a deep understanding of investments and financial statements, corporate finance, financial econometrics and advanced asset pricing. The final research project will give you hands-on experience, ensuring your competence in a financial decision-making environment. Follow this link to see the full programme syllabus.

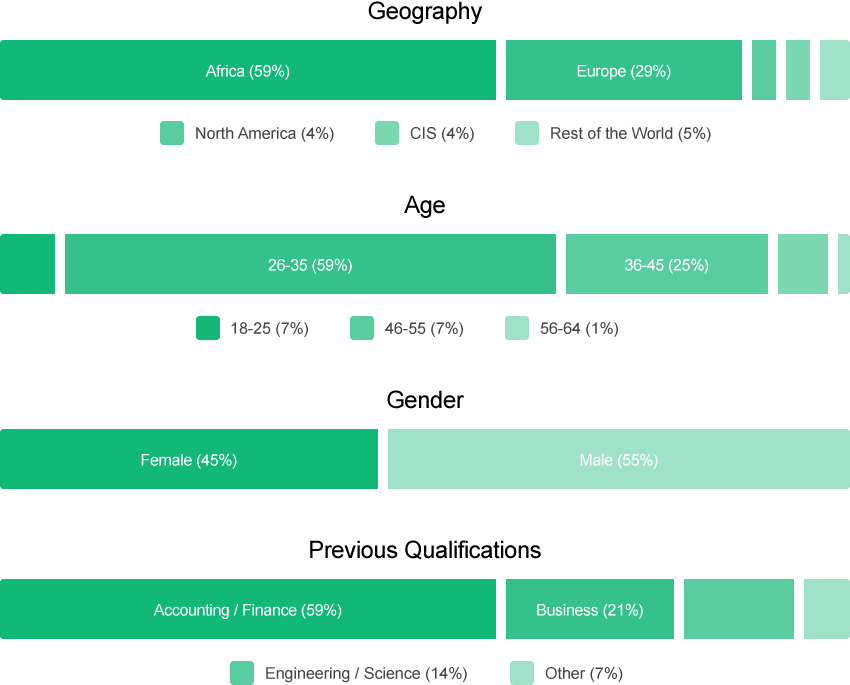

Information based on class of 2015-2016

This programme focuses on the key operations that are employed by businesses in the modern financial sector. During the course, students will master advanced financial theories, and enhance their skills in the following areas:

- Quantitative finance is a crucial component of this field, and a grasp on numerical operations such as linear algebra, algorithm, multi-variable calculus, differential equations, probability theories, and statistical analysis will make you a strong candidate for a financial position.

- Business and financial analysis capabilities are crucial for effective financial decision making. You’ll be able to demonstrate these analytical skills within the scope of corporate evaluation and the business sphere.

- Data synthesis and presentation experience is crucial in the finance industry for communicating effectively in a professional environment. You’ll learn how to examine and present findings to a varied audience, which will be applied in real-life financial settings.

- Risk management in the finance and investment fields can prevent or curb major financial losses. For a more comprehensive understanding of risk management and internal control, you’ll assess accountants’ responsibilities in identifying and mitigating risk within their organisation.

- Analysing strategies of M&A and private equity builds a foundation for better decision making in future transactions. You will complete an analysis of comparative issues in the field, and suggest improvements to a global organisation’s M&A and private equity strategies.

- Corporate governance and ethical requirements in the accounting field are critical points to be familiar with when working in finance and investment. Through analysis of internal concerns of corporate agencies, you will learn to identify market opportunities while maintaining accountability and ethical integrity.

Students can expect to gain the following skills while studying the Master in Finance and Investments in Mergers, Acquisitions and Private Equity:- Advanced financial decision-making;

- Methods in generating profits and minimising risks;

- Preparing domestic and international financial statements;

- Strategic financial and business analysis;

- In-depth knowledge of corporate governance and ethical issues.

This programme typically attracts students who are interested in learning about the financial strategies employed by multinational companies. Choosing a degree in the financial investment sector can help you land rewarding career opportunities as well as enhance your earning potential.

After completing this online course on mergers and acquisitions, students may qualify for a number of positions within the field of corporate finance. These are some of the highly-valued career options in the finance and investment sector:- Investment Banker – in this role, you would issue and sell securities to assist clients in raising capital, as well as analyse and execute financial deals. Investment bankers could work for multinational companies, and can earn up to £74,179 annually. They use strong quantitative skills to:

- Perform corporate restructuring;

- Suggest investment opportunities;

- Identify potential investors;

- Provide financial advice based on analysis;

- Conduct strategic research.

- Business Strategy Consultant – Business strategy consultants can be self-employed or work for consultancy firms, with an average annual salary of £53,459. They are also known as management consultants, who combine their knowledge of business and consultancy to:

- Expand their business or increase profits;

- Improve overall organisational effectiveness;

- Build and maintain a strong client base;

- Evaluate and transform business models.

- Product manager – In this role, you would specialise in determining product specifications, schedule and pricing, and can earn up to £56,037 annually. Their skills in competitive analysis and people management allow product managers to:

- Determine customer’s needs;

- Review product specifications;

- Define product marketing communications;

- Assess market data of products and services;

- Prepare a return on investment (ROI) analysis.

Ready to apply?London School of Business & Finance is a part of the Global University Systems group of companies (the GUS Group). The information you provide on this form will be processed in accordance with London School of Business & Finance's Privacy Policy. London School of Business & Finance will use the details provided by you to get in touch with you about your enquiry.Apply nowReady to Apply?Degrees, professional qualifications, and short courses delivered onlineChoose Exam Dates and Additional MaterialsAdd Billing DetailsSelect Payment Method